Beginnings are hard.

What Fintwit does a great job of is discussing individual stocks, strategies or even indexing - a conversation which appears to get less attention is how to construct a portfolio. My take on that is because it takes time to find your feet as an investor - the learning curve is so steep and the enthusiasm is so strong, the two collide and you get very mixed outcomes to begin with, take it from me!

1. First Attempt - Techno

Being fresh to the game, locked indoors during a pandemic - the market was a whirlwind of promise and the perfect time to find myself the next Google or the like. Zoom a company I had not even heard of two weeks prior was a 5 bagger in a matter of months - are these financial gains what I’d been missing out on for the last decade or so of my adult life? Following the rabbit hole of these euphoric headlines further led me down the road of next generation Tech ETF’s and funds - clearly baskets of stocks perfect for a new investor to ride with for the next decade or so?

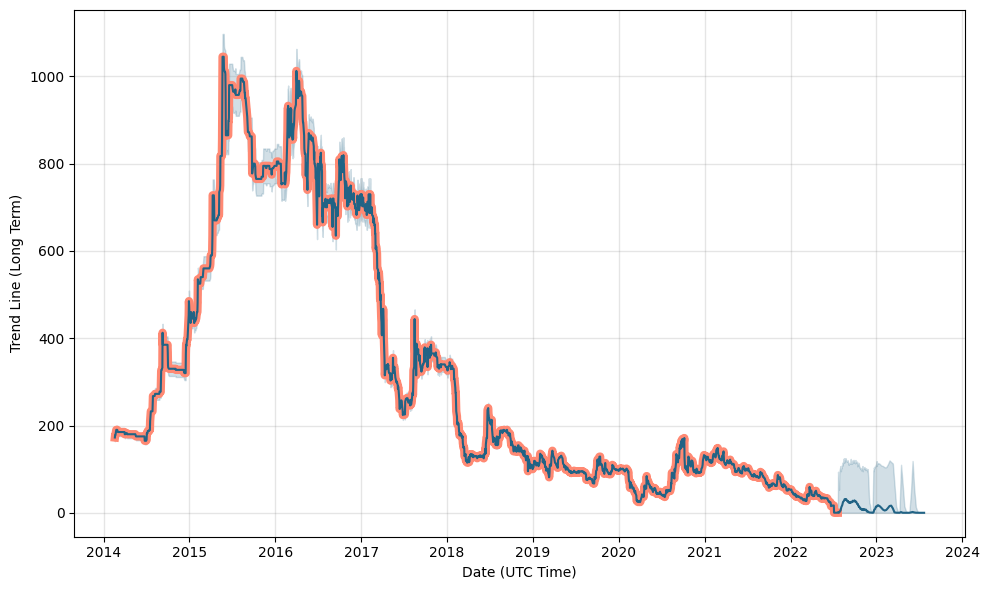

With haste and excess cash, I built a portfolio of 30 names, representing the top holdings of the ETF’s I had mulled over, as the ETF’s made changes, as did I. As you can imagine a year or two down the line I wasn’t impressed with my old self. Luckily losses were minimal as the bull market raged however luckily I had made inroads into my own learning and retreated somewhat. One nice example of a ‘hidden gem’ outside of the genomic stocks, EV’s or such was a little BioTech on the AIM market under the name of 4D Pharma - see the ugly chart below with the company since going bankrupt I believe.

Here were my future hard no’s.

Following others blindly may sound obvious but having my own conviction and stock criteria is key.

No AIM listed stocks (I’m sure there are a lot of quality companies but I’ve been burnt too often by management)

30 Stocks is unmanageable for me personally

4D Pharma’s car crash:

2. Second Attempt - Quality Street

Okay, a lot of lessons learnt, a lot of Buffet wisdom consumed - my next portfolio looked a lot like BRK 2.0 - finding my own ideas in large part and channeling my inner Charlie Munger. It’s got to be said this strategy did work a lot better albeit it felt that I always had an itch I needed to scratch - along with being caught up with a fair few value traps. Was investing even for me? Some reasonable performers I bought included the likes of Union Pacific, Bank of America and Barrick Gold.

Less hard no’s this time around (progress?)

If a stock is trading at a low multiple & I mean a LOW multiple, then maybe sense check these situations a little more

Dividends aren’t a must, if anything I’d like to be in a higher quality business which can still reinvest cash.

Another personal preference is to avoid mega cap companies - I have a long time horizon and rather invest in something with a smaller base

3. Third time lucky

Taking all I have learnt, finding more investing role models such as Bill Ackman, Chuck Akre, Chris Miller, Chris Mayer and lesser known but equally as influential Joseph Shaposhnik.

I feel I found my stride in terms of getting my portfolio preferences down, in terms of what works for me. Here are my preferences:

Serial Acquirers with high ROIC’s

HoldCo’s with great capital allocators and optionality

Recurring revenues

High insider ownership

Higher margins

Low debt

Allow small % of portfolio to scratch my itch for more ‘exciting’ moonshots

Portfolio to be comprised of 10 or less holdings

4. Current Holdings:

I will post about my individual holdings in far more detail however here is a short one liner on each:

Boston Omaha - BOC 0.00%↑

A diversified holding comapany

Thesis: Backing the jockeys in Alex & Adam - they have proven investment success, investing in high margin, recurring businesses with natural moats.

Pershing Square Holdings #PSH.L

A portfolio of quality companies

Thesis: At the time the discount to NAV was 40% combined with Bill Ackman’s track record of beating the market, buybacks and Bill’s ability to make macro' hedges.

Exor #EXO.AS

Family owned holding company

Thesis: (Similar to PSH) Again a 40% discount to NAV, great capital allocation, long term owner of great businesses, compounded BV for decades at attractive rates.

Kingsway Financial Services KFS 0.00%↑

Publicly listed Searcher fund and re investment vehicle

Thesis: Great management with skin in the game (a common theme in all of my holdings), using their core warranty business to thoughtfully build out their own internal searchers fund, accumulating established private SME’s at low multiples and gaining high IRR’s in the process.

Vinci Partner Investments Ltd VINP 0.00%↑

Latam Asset Manager

Thesis: I like asset manager names like Brookfield etc, Vinci is in the early innings of building out a similar business in the emerging LATAM market. The company is growing nicely, high ROE, insider ownership, margins and merging with Compass will expand their footprint significantly - the tailwinds are all there and it appears to be a great company to take advantage of this.

Howard Hughes HHH 0.00%↑

Master plan community builder and land owner

Thesis: This WILL need a deep dive however the underlying business model is very unique with a lot of advantages in their favour, currently trading at a depressed valuation as FCF isn’t quite showing…YET. Howard Hughes gets the dual benefit of the asset value naturally compounding alongside the build out of the master plan communities which also compound the asset value.

Topicus $TOI.V

Vertical software acquirer

Thesis: A baby Constellation Software, performing well, high insider ownership, large runway, EU exposure

Rocket Lab RKLB 0.00%↑

Rocket launch and space services provider

Thesis: A visionary founder believing a vertical platform is the most efficient way to achieve scale and implement ‘space services’ - which I believe depending on the vertical will have Saas like margins with a wider moat. TAM = endless

AST Spacemobile ASTS 0.00%↑

Space based direct to cellular internet

Thesis: Connecting the unconnected, a clear tech lead over Starlink and endorsed by the worlds largest telco providers: AT&T, Vodafone, Ratuken etc. This one is all about execution in return for huge FCF’s which dwarf the current market cap. (Again scratching the itch but not to the detriment to my core holdings.

(Will go into weightings another time)

Thanks for reading

DMS